Forex trading is fast-paced. To succeed, you need tools that are easy to use and can place trades swiftly. The most widely used trading platforms are currently MetaTrader 4 (MT4) and its updated version, MetaTrader 5 (MT5).

Developed by MetaQuotes Software Corp, millions of traders use the MT4 and MT5 platforms every day. They have intuitive interfaces and are suitable for all traders, from novices to experts.

Let’s dig into how these platforms work and how you can make the best use of them.

What Is MetaTrader 4?

MetaTrader4 launched in 2005 and has been a game-changer for Forex trading. It’s easy to use, has great analytical tools, and lets you automate trading through Expert Advisors (EAs).

Let’s break down how to use MT4, how to open and close positions, and how to use EAs for automated trading.

Getting Started With MetaTrader 4

MT4 is available for Windows, macOS, and mobile platforms (iOS and Android). Once installed, you can log in with your trading account credentials, which are provided by your broker.

Note: You can create a free account in MetaTrader 4 only for paper trading. To trade live markets, you’ll need to sign up with a Forex broker and connect MT4 to their platform. You must also verify your identity, provide your tax identification details, and go through a know-your-customer (KYC) check (be wary of brokers that don’t require this).

Once you submit your details, your documents will be reviewed. It may take a few days for MT4 to approve your application.

Features of MT4

When viewing from mobile, the home screen will open up the “Quotes” tab. This shows you the most popular currency pairs. You have the option to edit currency pairs on the top left. This is where you’ll select the pairs you want to trade.

The next tab on the bottom is “Charts.” It shows the candlestick patterns of whichever pair you want to track. In this section, you can also conduct market analysis. Some traders use other chart tools, such as TradingView, as it lets you plot more indicators. It all comes down to personal preference.

After Charts, you’ll see the “Trade” button. This is where you can place buy and sell orders.

How To Execute Buy and Sell Orders on MT4

Click on “Trade” on the mobile app. This will open the market order screen. At the top, you’ll see the option to select the desired currency pair. Next, you’ll see options for “Buy Limit,” “Sell Limit,” “Buy Stop,” and “Sell Stop.” For example, if you want to set a Sell Stop order, enter the price at which you want this order to trigger. Once the price moves down past this level, the order will be triggered. Do the same for Stop Loss and Take Profit levels. Then click on “Buy” to enter the trade.

Beginner traders should keep their orders simple. Don’t execute multiple orders at once. Also, remember these important rules:

- Buy Limit is placed below the current market price to open a long position.

- Buy Stop is placed above the current market price to short a position.

- Sell Limit is placed above the current market price to open a short position.

- Sell Stop is placed below the current market price to open a short position.

You can place two types of orders: a market order is placed at the current market price, while a pending order is executed according to your selection of price level. Start your Forex trading journey by placing limit orders so you can be in charge of the trade. And always be sure to set a stop-loss order.

You’ll then see a live P/L amount of all your open trades combined at the top of the screen. This will keep shifting as market prices change. Once you have open positions, you can modify or close them easily.

If you’re on mobile, then long press on the trade to modify stop-loss and take-profit levels. It also gives you the option to close the trade.

Using Expert Advisors

Expert Advisors are automated trading programs or scripts that can execute trades on your behalf based on predefined trading rules. EAs can analyze market data, make decisions, and execute trades without human intervention. They’re programmed to open, close, or modify trades based on parameters that you set.

To install an Expert Advisor:

- Download the EA from a trusted source or create your own using MQL4.

- Open the “Experts” file in the MetaTrader 4 directory.

- Copy the EA file (usually an .ex4 or .mq4 file) into the folder.

- Restart MetaTrader 4, and the EA will appear in the “Navigator” section under “Expert Advisors.”

Be sure to backtest and optimize the EA before using it in a live trading environment. Run your strategy with an EA and simulate its performance over historical data. You can then analyze its profitability and efficiency.

What Is MetaTrader 5?

MetaTrader 5 is a newer and more advanced trading platform. While MT4 revolutionized the trading world when it was released, MT5 has built upon that success and expanded to include many more features. For instance, traders can access multiple financial instruments on MT5, like Forex, stocks, indices, commodities, and cryptocurrencies.

Advanced Features of MT5

MT5 has an array of advanced features to support traders, such as:

- Technical Indicators: MT5 has 38 technical indicators available for comprehensive technical analysis. Traders can use these indicators to identify trends, assess momentum, and make informed decisions.

- Depth of Market View: MT5 offers a detailed view of the market, so you can gauge supply and demand at various price levels. This feature gives you a clearer picture of market dynamics.

- Automated Trading: You can set up EAs on MT5 to execute trades on your behalf. Traders can create customized EAs using MQL5 or choose from a vast marketplace of pre-built EAs within the MT5 platform.

- Economic Calendar: Traders can find the economic calendar in the “Market Watch” tab. To view more details about an event, simply click on the event in the calendar. You can also subscribe to the economic calendar to receive alerts.

- Multiple Time Frames: MT5 offers more time frames than MT4. Traders can do a granular analysis of price movements using different time frames and adapt their strategies accordingly.

- Hedging: MT5 allows for hedging positions. This feature gives traders the flexibility to manage their positions and use different risk management and profit generation strategies.

How To Use MT5 on Desktop

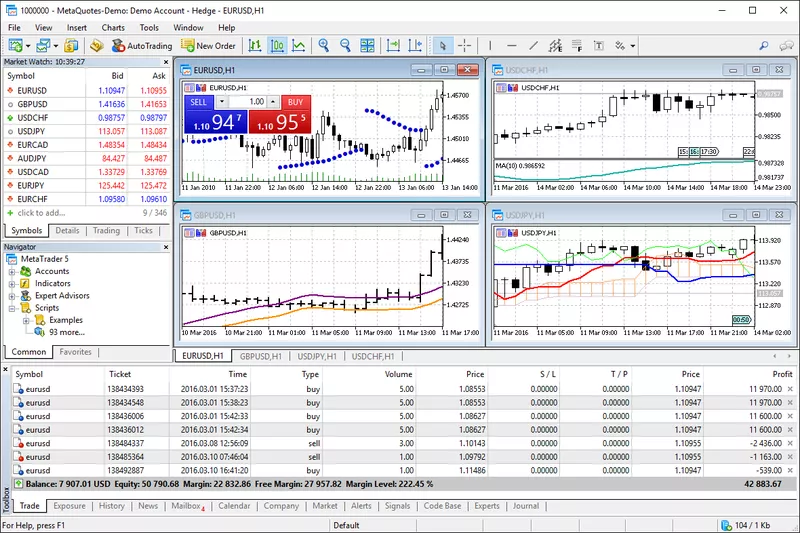

When you access MT5 on a desktop, you’ll see the home screen with four windows displaying charts and a navigation panel on the left.

- The Charts window can incorporate 100 charts (if you have the capacity to track them, of course).

- The Navigator window gives swift access to multiple features, such as indicators, EAs, market data, and trading signals.

- There’s also a Toolbar window where you’ll find a collection of shortcuts and line graphs that you can use on the charts.

- Last is the Market Watch window, which displays the available trading instruments, complete with their respective Bid and Ask prices.

Use the Main Menu at the top of the screen to switch between different accounts, change languages, and add indicators and graph lines to your chart.

How To Place Trades on MT5

Placing a trade on MT5 is pretty similar to MT4. When placing a trade via desktop, you’ll see these parameters:

- Symbol: Choose the currency pair that you want to trade.

- Type: You can choose between Instant Execution or Pending Order. This will depend on whether you want to trade at the current price or wait for the market to reach your expected level.

- Volume: This is where you can select the lot size of your trade. Beginners should use micro lots to limit their risk.

- Stop Loss: While this is an optional feature, you should always have a Stop Loss level to protect your capital. This will close the trade automatically if the market moves against you.

- Take Profit: This is also an optional feature. But setting up a Take Profit order will help you execute multiple small orders without having to track the price.

- Fill policy: This gives you the option to either Fill or Kill (execute the order fully or not at all). You can also choose Immediate or Cancel (execute immediately and as much as possible.)

- Comment: This is an option to leave a note on the trade.

MetaTrader 4: Pros and Cons

MT4 is a popular platform and has a very big user and developer community. Still, it has both advantages and limits.

Pros of MT4:

- User-Friendly Interface: MT4’s interface is intuitive, so it’s easy to use no matter your level of experience. The navigation is straightforward, and it gives quick access to different trading functions.

- Customization: Traders can customize MT4 extensively. This includes the ability to create custom indicators, EAs, and scripts. It’s a highly flexible platform for those who want to tailor their trading environment to their specific needs.

- Technical Analysis Tools: MT4 offers extensive technical indicators and charting tools to conduct in-depth technical analysis.

- Algorithmic Trading: Traders can automate their trading strategies with EAs, which execute trades and perform analysis 24/7. You can also backtest your strategies using historical data before you risk real capital. This is a valuable tool for strategy development and optimization.

- Wide Broker Support: MT4 is supported by several Forex and CFD brokers.

Cons of MT4:

- Limited Asset Coverage: MT4 is primarily designed for Forex trading and doesn’t provide the same level of access to other asset classes like stocks and commodities, unlike its successor, MetaTrader 5 (MT5). Traders looking to diversify their portfolios might find this limiting.

- Outdated Technology: MT4 uses an older MQL4 programming language, which can limit the sophistication of custom indicators and EAs. MT5, on the other hand, employs MQL5, offering more advanced capabilities for programmers.

- Limited Time Frames: MT4 has a finite selection of time frames, which can be a constraint for traders who prefer more granular data for their technical analysis.

- No Hedging in Some Regions: It doesn’t support hedging or netting in some regions.

MetaTrader 5: Pros and Cons

MT5 uses the latest technology and has several benefits over MT4. Still, there are some downsides as well.

Pros of MT5:

- Comprehensive and Versatile: MT5 offers a fuller and broader range of features, so it’s suitable for traders with various trading styles and preferences.

- Multi-Market Support: Unlike MT4, it supports multiple financial instruments, including Forex, stocks, commodities, cryptocurrencies, and indices. It’s useful for traders looking to diversify their portfolios.

- Better Performance: MT5 can handle a greater number of indicators, time frames, and chart windows without sacrificing speed or stability.

- Advanced Technical Analysis: MT5’s extended set of technical analysis tools and indicators lets traders conduct more in-depth and accurate analyses. This is especially helpful if technical analysis is part of your strategy.

- Hedging Support: Traders can open both long and short positions on the same asset, providing greater flexibility for risk management.

Cons of MT5:

- Less Popular: MT5 isn’t as popular as MT4, which means it may not be available with as many brokers. Some traders may prefer to stick with MT4 due to its familiarity and widespread use.

- Smaller User and Developer Community: MT4 has a large and active user and developer community that provides substantial support, feedback, and resources. By contrast, the newer MT5 has a smaller community, which can limit the availability of third-party resources and assistance.

- Complex: MT5’s advanced features can be harder for beginners to grasp.

MT4 vs. MT5 Takeaways

The Funded Trader is compatible with both MT4 and MT5 platforms. But which one should you use? Overall, there aren’t many differences between the two platforms. It all comes down to a matter of preference. MT4 is more suitable for beginners. It provides a straightforward and user-friendly environment to help you learn the ropes of trading. MT5, on the other hand, offers more technical indicators and time frames.

Regardless of which one you choose, remember that it’s your strategy—not the tool— that will determine your success. Even though MT4 has fewer features, you can still use it to execute a well-defined trading plan.

In the end, choose the platform you’re most comfortable with. Focus instead on testing and improving your strategy, skills, and mindset. With time, you’ll be able to adapt to the dynamic market conditions and improve your win rate.

Join The Funded Trader Challenge today to test your strategies and generate profit.