FundedNext has generated buzz as an evaluation firm and simulated trading platform. Through this firm, retail traders can buy and sell currency pairs, indices, and commodities. The platform also gives opportunities to promising traders who show advanced trading strategy savvy. But FundedNext is but one of many such firms, so you must consider its pros and cons before you choose.

What Is FundedNext, and How Does It Work?

Before we get to the pros and cons, let’s do a basic review of FundedNext and how it works. FundedNext offers a simulated funded trading opportunity to people who pass its challenge program. The platform has three types of challenges:

- Evaluation: This two-phase evaluation challenge prompts participants to hit a 10% and 5% profit in the allotted timeframes.

- Express: With a higher profit target of 25%, the Express Challenge requires more skill and a disciplined mind. But those who take the Express Challenge will have no time limits and receive 15% profits from their challenge phase.

- Stellar: The simplified and streamlined Stellar Challenge involves specific profit targets without time limits. Lower profit targets make passing the Stellar Challenge more attainable.

If you become a simulated funded trader with FundedNext, you can receive up to $300,000 in virtual capital. Payout splits climb as high as 95% with their scaling option. New participants have the unique opportunity to earn 15% of their profits generated during the challenge phases.

They also offer:

- Virtual balance-based drawdowns provide advantages to traders who keep positions open overnight

- No time limits on certain challenges

- Competitive commissions

What Are the Pros and Cons of FundedNext?

All evaluation firms have advantages and disadvantages. Be sure you understand the pros and cons of FundedNext before you sign up for a simulated account.

Pros

FundedNext offers a 90% payout split, which traders can increase to 95% by selecting an optional account add-on when they become a virtual funded trader. These exceptional rates represent some of the highest in the industry and mark a major advantage of the platform.

They also offer partner day traders and retail traders a 15% share of the virtual profits they generate during the challenge phase. This rare feature marks another appealing differentiator, as many other evaluation firms don’t share virtual profits from challenges.

Additional pros include:

- A globally accessible platform

- Fast payouts

- Flexible trading policies that facilitate overnight trading, weekend trading, and simulated news trading

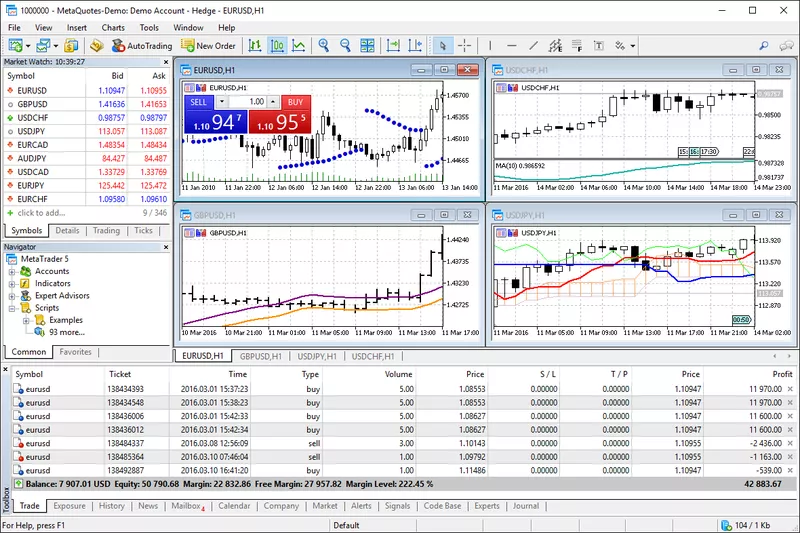

- Access to expert advisors (EAs) and market indicators

- Strong community support

As of January 2023, FundedNext had paid out a reported $51 million in virtual funds to members of its trading network. This indicates high levels of reliability and financial stability.

They support Forex, commodities, precious metals, and indices. Evaluation-level participants qualify for an unlimited number of free retries if they fail a challenge, and funded traders can access up to 100x leverage.

Cons

Traders operating through FundedNext cannot trade cryptocurrencies, as the firm doesn’t give traders access to these markets. Crypto holds strong appeal to many retail traders and day traders since its typically sharp price swings offer enormous payout potential. But if you trade exclusively through FundedNext, you’ll miss out on these enticing opportunities.

Additional drawbacks include:

- No copy trading

- Express accounts are subject to consistency rules

- No free trials

- Trading-day minimums apply to many account types

How Does FundedNext Compare to Other Evaluation Firms?

Direct comparisons can also help you weigh the pros and cons of FundedNext. So, let’s look at how they stack up against four leading competitors.

FundedNext vs. FTMO

FundedNext and FTMO align relatively closely, with just a few technicalities and details differentiating the two platforms. FTMO offers access to cryptocurrency markets and stocks, while FundedNext does not. However, FundedNext maintains a $4 million maximum virtual account balance, while FTMO caps simulated account balances at $2 million.

FundedNext vs. The5ers

The5ers is a London-based evaluation firm that also offers challenge programs leading to funded trading opportunities. Its payout targets, virtual daily and overall drawdown limits, and leverage maximums align closely with those used by FundedNext. However, the pros and cons compared to The5ers include:

- The5ers offers instant funding and three-step evaluation programs, but FundedNext doesn’t.

- The5ers cap initial virtual allocation capital at $100,000, which is lower than FundedNext’s upper limit.

- A monthly salary and 100% payout-sharing are attainable through The5ers, but FundedNext offers neither.

FundedNext vs. Funded Trading Plus

London-based Funded Trading Plus also offers instant funding, with an initial virtual capital allocation of up to $2.5 million. These enticing features come with some tradeoffs, though:

- Funded Trading Plus caps leverage at 30x, whereas FundedNext offers up to 100x.

- Funded Trading Plus imposes virtual daily drawdown limits of just 3%, compared to the 5% that applies to most FundedNext programs.

Also, simulated cryptocurrency trading is available through Funded Trading Plus but not FundedNext.

FundedNext vs. The Funded Trader

The Funded Trader is a Texas-based evaluation firm offering one- and two-phase challenges with no trading period limits. In these regards, The Funded Trader and FundedNext are similar. But several key differences separate the two platforms, such as:

- The Funded Trader offers an initial capital allocation of up to $1.5 million in virtual funds, compared to FundedNext’s $300,000.

- The Funded Trader offers access to three different brokers (Eightcap, Purple Trading Seychelles, and ThinkMarkets), compared to two for FundedNext.

- Traders can buy and sell simulated cryptocurrency through The Funded Trader network.

- FundedNext’s Express Challenge programs have much higher payout targets (25%) compared to The Funded Trader (10%).

Why The Funded Trader Is a Better Alternative to FundedNext

After reviewing the pros and cons of FundedNext and comparing it to other evaluation firms, we believe The Funded Trader to be a better option.

The Funded Trader has excellent reviews and enjoys widespread popularity. While FundedNext is also well-reviewed, it appears to have a significantly smaller base of active users. Funded traders can also access up to five times as much virtual trading capital by working with The Funded Trader, which dramatically elevates payout potential.

What’s more, traders partnering with The Funded Trader can customize their risk parameters, trade in virtual cryptocurrency markets, and access performance-based scaling. The Funded Trader also offers excellent transparency, which is critical to maintaining its elevated reputation.

Join The Funded Trader and Start Earning Virtual Profits

With global accessibility, attainable payout targets, diversified broker and market access, and full support for a complete set of tradable assets, The Funded Trader offers outstanding opportunities to promising traders. You can also qualify for up to $1.5 million in virtual funding, creating the potential to earn fantastic payouts.

These features combine to make The Funded Trader one of the industry’s most compelling and popular evaluation firms. Learn more about The Funded Trader’s challenge programs and get started today.